Finally, it's now possible for Blogger users to verify Blogspot blogs on Google Sitemaps (see the Sitemaps blog post yesterday, plus Saffa Dude's comment also pointing that out).

It's not only Blogspot members who benefit - if you use some other blogging platform which doesn't let you upload files to your blog host's servers, but does let you tinker with your blog template (specifically the head section of your blog's webpages), now you can verify your blog too.

For those who don't know: what's Google Sitemaps, and why would you want to verify your blog? In summary, you'd want to add your blog to Sitemaps and verify it in order that:

- your blog gets indexed better by Google, so that people will hopefully be more likely to find your blog's webpages when they search on Google;

- when you update your blog, e.g. write a new post, you can ping Google, i.e. get Google to come and re-crawl your blog very quickly, so that people who search Google will find the most current information about your blog; and

- you can get more info about how Google indexes your blog, and maybe tweak it to improve the likelihood of people finding your blog in future when searching on Google.

How to submit your blog sitemap, and verification

I've already explained briefly and in more detail how to submit your blog sitemap to Google (including why it's important to make your feed file as full as possible for that purpose - you can still offer your readers or subscribers headlines or excerpts-only feeds, if you wish).Previously we mere Blogger users, and others who don't have permission to upload files to their blog host server's root, were deprived of the ability to verify our blogs on Sitemaps, which I for one thought was ludicrous given that Google own Blogger (and I kept saying so).

Clearly I wasn't the only one - finally, in February, Google asked for views on whether people wanted to be able to verify their blogs or sites in other ways, and as mentioned in the Sitemaps blog post yesterday, the response was overwhelmingly "YES!!"

So now they've provided a way to verify your blog via a meta tag.

How to verify your blog on Sitemaps

Google have provided instructions on how to verify your blog or site. Here's a step by step (this assumes you've already (1) signed up with Google Sitemaps as per my previous post; and (2) for Add Site, entered the URL of your blog e.g. http://consumingexperience.blogspot.com in my case):1. Login to Sitemaps.

2. Against the name of the blog or site you want to verify, under the Site Verified? column, click the Verify link:

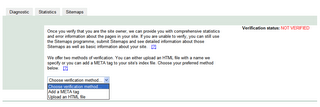

3. You get a new page. In the Choose verification method dropdown, pick Add a META Tag:

3. You get a new page. In the Choose verification method dropdown, pick Add a META Tag: 4. A box appears under the dropdown, with some code in it, it looks something like this (I've airbrushed out the one for my blog!):

4. A box appears under the dropdown, with some code in it, it looks something like this (I've airbrushed out the one for my blog!): 5. Copy that code from <META all the way to /> (be careful not to copy the box instead of the text inside the box).

5. Copy that code from <META all the way to /> (be careful not to copy the box instead of the text inside the box).6. Go to your blog template (it's easiest to do this in a new browser window or browser tab) and paste that code between your head tags - Google have given an example (opens in new window) showing how and where to put it. Save the template changes, and republish your blog.

7. Now go back to Google Sitemaps and tick the checkbox against "I have added the META tag to the home page of [your blog name]" (which is just under the box with the new code, see the pic above), and then click the Verify button.

That's it. It worked to verify my blog nearly instantly.

What do you get with verification?

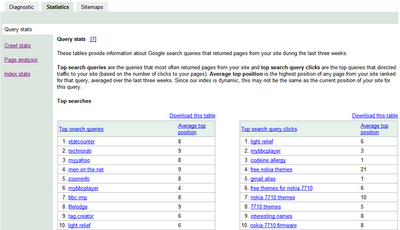

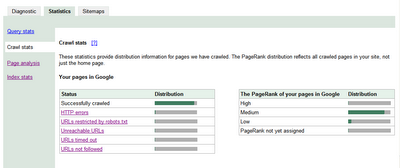

Now, whenever you login to Sitemaps, you'll get 3 tabs:- Diagnostics

- Statistics and

- Sitemaps.

Statistics is I think the most useful. It gives you access to Google stats about your blog, like query stats (which tell you what visitors were looking for, what words they searched on when they came to your site via Google, so that you can tweak your blog content to try to improve your blog's ranking on Google), crawl stats, page analysis and index stats.

Statistics is I think the most useful. It gives you access to Google stats about your blog, like query stats (which tell you what visitors were looking for, what words they searched on when they came to your site via Google, so that you can tweak your blog content to try to improve your blog's ranking on Google), crawl stats, page analysis and index stats.Here for example are my recent query stats - not quite full-fledged web analytics, but useful given that Google searches can be a prime source of referrals to your blog (certainly for my own blog, I'd say 90% of my visitors come via Google):

Crawl stats can also be useful:

Crawl stats can also be useful: For example, HTTP Errors, Unreachable URLs, URLs timed out and URLS not followed can give you info on problem pages on your site, e.g. pages "that [Google] tried to crawl (found either through links from your Sitemaps or from other pages) but could not access. If these pages are listed in your Sitemap or linked from your site, make sure that the URLs are correct" - in other words, this can help you spot and fix broken links to your own pages from within your own blog (yes, an easy enough to make a mistake sometimes!). (You can also reach the detailed crawl stats info from the Diagnostics tab.)

For example, HTTP Errors, Unreachable URLs, URLs timed out and URLS not followed can give you info on problem pages on your site, e.g. pages "that [Google] tried to crawl (found either through links from your Sitemaps or from other pages) but could not access. If these pages are listed in your Sitemap or linked from your site, make sure that the URLs are correct" - in other words, this can help you spot and fix broken links to your own pages from within your own blog (yes, an easy enough to make a mistake sometimes!). (You can also reach the detailed crawl stats info from the Diagnostics tab.)There's more info about all this in Google's revamped Webmaster help centre (and - updated 6 and 10 May - Google have also now provided more guidance and answered some common questions about the new meta tag and Blogger's own blog Buzz has also highlighted this new feature). Happy verifying, stats checking and blog tweaking!

Tags: